State Of Nm Unclaimed Money

NM Tax Department reports $390M in unclaimed property • Source New Mexico

10:45 Brief The state can end up with unclaimed property through a variety of circumstances, including death, job changes and moves. Such property runs the gamut, from money to uncashed checks to safe deposit box contents and more. According to a news release, individual claims average $500.

https://sourcenm.com/briefs/nm-tax-department-reports-390m-in-unclaimed-property/

New Mexico – National Association of Unclaimed Property Administrators (NAUPA)

Dormancy Periods The following dormancy periods are listed in years, unless otherwise noted. Reporting and Payment Due Dates The following indicates the report and payment due dates for the various property types. Electronic Reporting Capability Schedule The following indicates which types of reporting formats are accepted by this state.

https://unclaimed.org/reporting/new-mexico/

News & Alerts : Taxation and Revenue New Mexico

Explore Section & Events News & Alerts Click here to sign up for notifications. Press Releases 2026 01/12/26 New Mexico to begin accepting electronic income tax returns Jan. 16 01/12/26 Delinquent property tax auctions scheduled in January 2025 12/29/25 $940 million saved for New Mexicans in FY25 through tax programs, cuts 12/16/25 Taxation and Revenue Department cuts audit findings by 94% since 2018 12/08/25 New Mexico forecasts conservative ...

https://www.tax.newmexico.gov/news-alerts/

Access to this page has been denied

People can search and file a claim for unclaimed property in New Mexico by clicking here. Add as preferred source on Google. Copyright 2026 ...

https://www.krqe.com/news/new-mexico/could-some-of-new-mexicos-390m-in-unclaimed-property-belong-to-you-heres-how-to-check/Site Not Available

Sorry, this content is not available in your region.

https://www.koat.com/article/new-mexico-unclaimed-money-property/695453962025 Fall Unclaimed Reporting Guide (Part III) - Unclaimed Property Professionals Organization

Fall reporting season is upon us yet again. Most U.S. states require holders to file reports by either Oct. 31 or Nov. 1. Following are reporting deadlines for these states, along with helpful links. This list is not exclusive to a specific holder industry, so please check the states’ websites for information on industry-specific reporting information and deadlines.

https://www.uppo.org/blogpost/925381/513729/2025-Fall-Unclaimed-Reporting-Guide-Part-III

New Mexico Tax and Revenue is holding $390M in unclaimed property. Yep, you read that right. Old tax refunds, forgotten utility deposits, uncashed checks—it could be yours! With the holidays around the corner, that extra cash could help with gifts, groceries, or just a little breathing room.

https://www.instagram.com/p/DRpiGL2jNYC/

State-by-State Reporting Information – National Association of Unclaimed Property Administrators (NAUPA)

· National Association of Unclaimed Property Administrators, a Network of the National Association of State Treasurers. English. Español ...

https://unclaimed.org/state-reporting/

The taxman owes at least 16K N.M. taxpayers money • Source New Mexico

4:21 Brief A few thousand New Mexican taxpayers are missing out on some money in their pockets. About 16,700 tax rebate checks sit in Unclaimed Property in an account controlled by the New Mexico Taxation and Revenue Department. That’s at least $6 million in money the state is looking to give back to residents who filed their 2022 tax returns.

https://sourcenm.com/briefs/the-taxman-owes-at-least-16k-n-m-taxpayers-money/

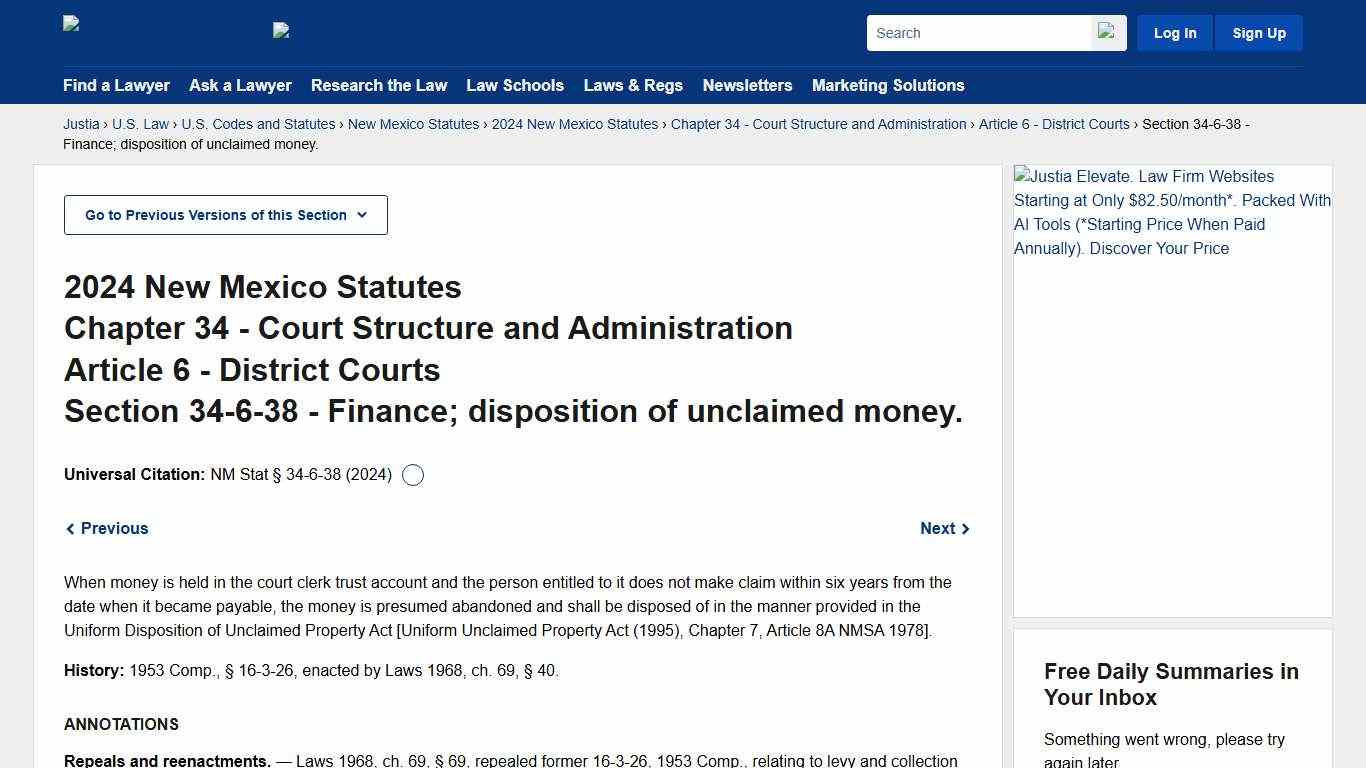

New Mexico Statutes Section 34-6-38 (2024) - Finance; disposition of unclaimed money. :: 2024 New Mexico Statutes :: U.S. Codes and Statutes :: U.S. Law :: Justia

2024 New Mexico Statutes Chapter 34 - Court Structure and Administration Article 6 - District Courts Section 34-6-38 - Finance; disposition of unclaimed money. When money is held in the court clerk trust account and the person entitled to it does not make claim within six years from the date when it became payable, the money is presumed abandoned and shall be disposed of in the manner provided in the...

https://law.justia.com/codes/new-mexico/chapter-34/article-6/section-34-6-38/

Webinar - Escheatment Essentials: Managing Dormant Accounts & Unclaimed Property

We use cookies so that we can remember you and understand how you use our site. If you do not agree with our use of cookies, please change the current settings found in our Cookie Policy. Otherwise, you agree to the use of the cookies as they are currently set.

https://www.icbanm.org/ev_calendar_day.asp?date=3/4/2026&eventid=1572

New Mexico Escheatment Guide Eisen

New Mexico For businesses operating in the Land of Enchantment, unclaimed property compliance is more than a legal requirement—it’s a matter of trust and accountability. At Eisen, we streamline New Mexico’s escheatment process, helping you track dormant property, meet deadlines, and avoid unnecessary penalties.

https://www.witheisen.com/state-guides/new-mexico

$14.3 million in New Mexico child tax credits left unclaimed. A letter is going out from the New Mexico Taxation and Revenue Department to individuals that did not claim this credit but appear eligible. If an individual is eligible, consider filing or amending your 2023 and 2024 tax return.

https://www.instagram.com/p/DM81zHguiQd/